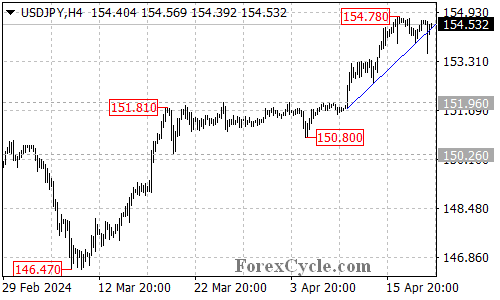

USDJPY’s recent price action suggests a shift in momentum. This analysis examines the technical situation and explores potential scenarios for the currency pair.

USDJPY Breaks Trend Line Support:

- Uptrend Consolidation Likely: USDJPY has decisively broken below the rising trend line on its 4-hour chart. This technical development suggests that the strong uptrend from 146.47 may be pausing for a lengthier consolidation phase.

Range-Bound Trading Expected:

- 152.50 – 154.78 as Trading Range: In the near future, the price action of USDJPY is likely to become range-bound between the support level at 152.50 and the resistance level at 154.78. This range represents the recent highs and lows.

Uptrend Resumption or Reversal?

- 152.50 Support Crucial: The overall uptrend could still resume if the support level at 152.50 holds. A bounce off this level would be a bullish sign.

- Breakout Watch at 154.78: A breakout above the resistance level at 154.78 would be a significant development. This move could signal a continuation of the uptrend and potentially trigger another rise towards 157.00.

Overall Sentiment:

The technical outlook for USDJPY has become uncertain in the short term. The breakdown of the trend line suggests a consolidation phase. However, the direction of the trend will depend on how price behaves around the key support and resistance levels. Monitoring price action around these levels is crucial to determine if the uptrend resumes or if a more sustained correction unfolds.