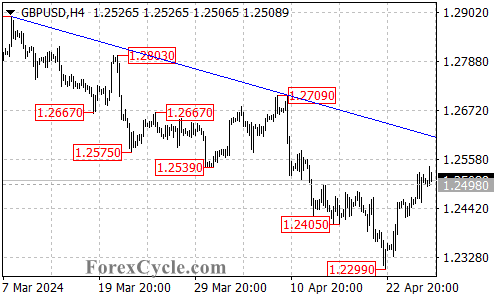

GBPUSD has displayed positive momentum, climbing from recent lows. This analysis examines the technical situation and explores potential scenarios for the currency pair.

GBPUSD Stages Rally:

- Upside Move Gains Traction: GBPUSD has extended its rise, reaching a high of 1.2540. This move builds on the upward momentum from the initial low at 1.2299.

Uptrend or Correction? Trend Line in Focus:

- Falling Trend Line Resistance: A key factor to consider is the falling trend line on the 4-hour chart, currently around 1.2610. As long as this trend line resistance holds, the recent bounce from 1.2299 could still be interpreted as a correction within the longer-term downtrend that began at 1.2893.

- Upside Targets: If the uptrend strengthens, the next potential target zones to watch are 1.2570 and the falling trend line itself.

Downtrend Shadow Looms:

- Downtrend Resumption Risk: If the correction scenario holds true, then another decline towards 1.2300 after the rally could be possible.

Support Levels to Consider:

- 1.2460 Initial Support: The initial support level to monitor is at 1.2460.

- 1.2400 Support Zone: A break below 1.2460 could bring the price back towards the 1.2400 area.

- 1.2300 Crucial Support: The key support level remains at 1.2300. A decline below this level would signal a potential resumption of the downtrend from 1.2893.

Overall Sentiment:

The technical outlook for GBPUSD is uncertain in the short term. The recent rally suggests a potential uptrend, but confirmation depends on the price action around the key support levels and the falling trend line. Close monitoring of these levels is crucial to determine if the uptrend holds or if a correction unfolds within the downtrend.