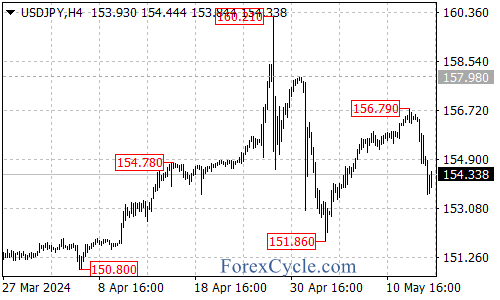

The USDJPY currency pair has extended its impressive upside move, rallying from the 151.86 low to a high of 156.79 in recent trading sessions. However, the pair has since pulled back from the 156.79 high, with the current decline likely a corrective move within the broader uptrend.

Potential for Further Upside After Correction

After the current pullback runs its course, another rally toward the 158.00 area appears possible for the USDJPY pair.In the near-term, the first level of resistance to watch on the topside is the 155.00 handle. A breakout above this level could potentially trigger an upside move to retest the 156.79 high.If buyers can push the USDJPY above 156.79, the next key target would be the 158.00 zone.

Downside Risks Remain

While the broader technical outlook remains constructive, traders will want to keep a close eye on the 155.00 resistance level. As long as this level caps any rallies, the current downside move from 156.79 could potentially continue.In this scenario, the next key support to watch would be the 153.00 area. A breakdown below 153.00 would open the door for a retest of the 151.86 low.

Key Levels to Watch

For now, the key levels to watch in the USDJPY are the 155.00 and 156.79 resistance levels, along with the 153.00 and 151.86 support areas.

As long as the pair remains above 153.00 support, the overall technical bias will remain tilted to the upside, with the potential for a continuation move toward the 158.00 target after the current correction.

However, a breakdown below 153.00 and 151.86 would likely signal a more substantial pullback is underway within the broader uptrend.

The USDJPY has pulled back from its highs, but the broader uptrend remains intact for now. Traders will want to closely monitor the key support and resistance levels to determine if the current correction is complete or if a more significant pullback could unfold before the next upside move.