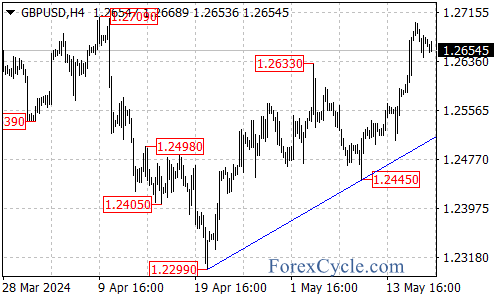

The GBPUSD currency pair has broken out above the 1.2633 resistance level, rallying as high as 1.2700 in recent trading sessions. The bullish momentum shows no signs of letting up just yet, with the potential for further gains over the coming days.

1.2800 Next Upside Target

Following the breakout above 1.2633, the first key resistance level to watch on the topside is the 1.2700 handle. If buyers can push the GBPUSD above this level, it could potentially trigger an upside continuation move toward the next target in the 1.2800 area.The path of least resistance for the pair remains skewed to the upside while it trades above the 1.2615 support.

Key Support at 1.2615

In the near-term, the first level of support to watch is at 1.2615. A breakdown below this area could see the GBPUSD pair retrace back toward the rising trendline support visible on the 4-hour chart, currently intersecting around the 1.2510 level.As long as the 1.2615 support holds, the near-term technical bias will remain tilted to the upside, with the potential for a rally toward the 1.2800 target.

Upside Momentum Remains Strong

For now, the GBPUSD uptrend remains firmly in place, with the path of least resistance pointing to further gains toward the 1.2800 level if buyers can push the pair above the 1.2700 resistance.

However, traders will want to keep a close eye on the 1.2615 support area for potential signs that a more significant pullback toward the 1.2510 trendline support could be underway.

The key levels to watch in the GBPUSD are the 1.2700 and 1.2800 upside targets, along with the 1.2615 support and the rising 4-hour trendline support currently near 1.2510.

The GBPUSD uptrend shows no signs of stalling, with the pair extending its rally above the 1.2633 resistance. While further gains appear likely, traders will want to closely monitor the key support levels for potential signs that the bullish momentum could be waning.