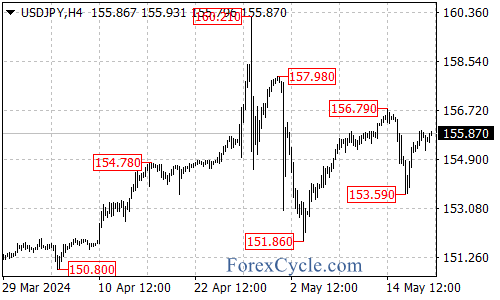

After a corrective pullback from the 156.79 high, the USDJPY currency pair has rebounded from the 153.59 low. The bounce has extended to as high as 155.97 in recent trading sessions, with the bullish momentum showing signs of picking up steam once again.

Further Upside Potential

Following the rebound from 153.59, further upside follow-through in the USDJPY appears likely over the coming days. The first key resistance level to watch is the 156.79 previous high.If buyers can push the pair above 156.79, it would likely signal that the broader upside move from the 151.86 low has resumed, with the next target on the topside in the 158.00 area.

Key Support at 155.10

While the technical outlook has shifted back to a more bullish bias, traders will want to keep a close eye on the 155.10 area as initial support. A breakdown below this level could see the USDJPY retrace back toward the 153.59 support zone.If the 153.59 support gives way, it would open the door for a potential decline toward the 153.00 area.

Levels to Watch

For now, the key levels to watch in the USDJPY are the 156.79 resistance, along with the 155.10, 153.59, and 153.00 support areas.

As long as the pair remains above 155.10 support, the near-term technical bias will remain tilted to the upside, with the potential for a continuation move toward the 156.79 and 158.00 resistance levels.

However, a breakdown below 155.10 and 153.59 would likely signal a more substantial pullback is underway, with the potential for a retest of the 153.00 support.

The USDJPY has regained its bullish momentum after the recent pullback, with the pair rebounding from the 153.59 low. While further gains appear likely, traders will want to closely monitor the key support levels for potential signs that the upside momentum could be stalling.