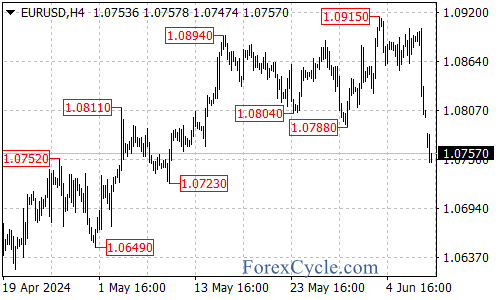

The EURUSD currency pair has broken below the key 1.0788 support level, indicating that the recent upside move from the 1.0600 low has likely completed at the 1.0915 high. This technical breakdown has opened the door for a potential bearish correction.

Further Downside Risks After Consolidation

Following the break of the 1.0788 support, the next key downside target for the EURUSD is located in the 1.0720 area.While some near-term consolidation may unfold, the path of least resistance for the pair appears to be further losses, with the potential for a decline toward the 1.0650 zone if the 1.0720 support is taken out.

Resistance Levels to Watch

In the near-term, the first level of resistance to watch on the topside is the 1.0770 area. A breakout above this level could potentially see the EURUSD retrace back toward the next resistance in the 1.0790 region.However, only a move back above the 1.0790 level would ease the downside pressure and potentially signal a more significant rebound.

Downside Momentum Building

For now, the technical outlook has shifted to a more bearish bias following the breakdown below the 1.0788 support. The path of least resistance appears to be further losses toward the 1.0720 and 1.0650 targets.Only a move back above the 1.0770 and 1.0790 resistance levels would ease the downside pressure and shift the bias back to a more neutral stance.

Key Levels to Watch

The key levels to watch in the EURUSD are the 1.0720 and 1.0650 downside targets, along with the 1.0770 and 1.0790 resistance barriers.

As long as the pair remains below 1.0770, the overall technical bias will remain bearish, with the potential for a more significant decline toward the 1.0650 area if the 1.0720 support is taken out.

The EURUSD has shifted to a more bearish technical outlook after the recent breakdown below the 1.0788 support. Traders will want to closely monitor the price action around the key support and resistance levels highlighted to determine if the downside momentum will continue to build or if a more significant rebound could unfold.