The EUR/USD pair experienced a mixed trading session on Monday, with some interesting technical developments that could shape its near-term direction.

Key Takeaways:

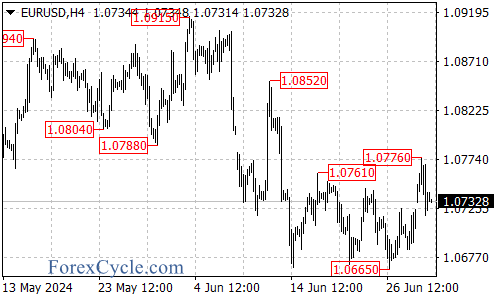

- Support found above 1.0720

- Resistance encountered below 1.0780

- Potential for continued upward movement despite recent decline

Possible Scenarios

If the EUR/USD manages to stabilize above 1.0705 today, we could see a bullish push targeting the 1.0765 to 1.0800 range.

Important Levels to Watch

Resistance levels:

- Short-term: 1.0740 – 1.0745

- Significant: 1.0760 – 1.0765

Support levels:

- Short-term: 1.0705 – 1.0710

- Significant: 1.0685 – 1.0690

What This Means for Traders

The current price action suggests that while the EUR/USD has experienced a short-term decline, the overall trend may still lean bullish. Traders should keep a close eye on how the pair behaves around the key support level of 1.0705. A bounce from this area could signal a resumption of the upward movement.

However, it’s crucial to remain cautious and watch for any breaks below the significant support level at 1.0685, which could indicate a shift in the short-term trend.

As always, it’s advisable to use proper risk management techniques and consider multiple timeframes and fundamental factors alongside this technical analysis.