The EUR/USD pair experienced a mixed trading session on Tuesday, with some interesting technical developments that could shape its near-term direction.

Key Takeaways:

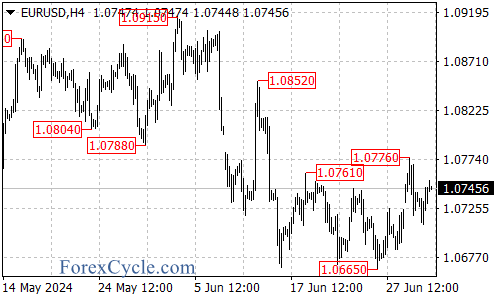

- Support found above 1.0710

- Resistance encountered below 1.0750

- Potential for continued upward movement despite recent decline

Possible Scenarios

If the EUR/USD manages to stabilize above 1.0715 today, we could see a bullish push targeting the 1.0760 to 1.0770 range.

Important Levels to Watch

Resistance levels:

- Short-term: 1.0755 – 1.0760

- Significant: 1.0765 – 1.0770

Support levels:

- Short-term: 1.0715 – 1.0720

- Significant: 1.0695 – 1.0700

Retail Trader Sentiment

Recent retail trading data shows:

- 57.14% of traders are long on EUR/USD

- The ratio of long to short traders is 1.33

- Long positions have increased by 26.08% since yesterday and 6.42% since last week

- Short positions have decreased by 18.26% since yesterday and 15.81% since last week

Market Outlook

Given our contrarian view on market sentiment, the dominance of long positions suggests that EUR/USD prices may continue to fall. The current sentiment, combined with recent changes, strengthens our bearish outlook for EUR/USD.

Traders should keep a close eye on how the pair behaves around the key support and resistance levels. While there’s potential for upward movement, the overall sentiment and technical indicators suggest caution for those considering long positions.