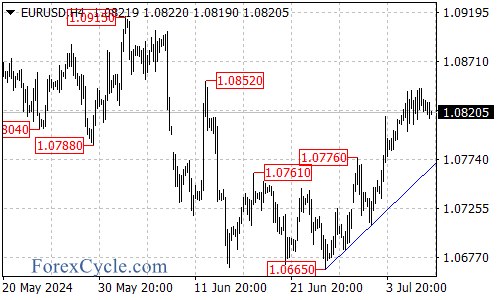

Since last week, the euro has been gaining strength against the dollar, continuing its upward trend yesterday and briefly touching a high of 1.0844.

Key Factors Influencing the Euro’s Performance

The main driver behind the euro’s exchange rate continues to be market expectations regarding monetary policies in both the US and Europe. Let’s break down the current economic landscape:

- Eurozone Economic Data:

- The July Sentix Investor Confidence Index for the Eurozone plummeted to -7.3, its lowest level in four months.

- May retail sales in the Eurozone grew by 0.1% month-on-month, falling short of the expected 0.2%.

- These figures suggest that the Eurozone’s economic growth remains sluggish, with a weak foundation for recovery.

- ECB Monetary Policy:

- After cutting interest rates by 25 basis points in June, market expectations for further rate cuts by the European Central Bank (ECB) this year remain close to two.

- Federal Reserve Outlook:

- With slowing US economic growth and cooling inflation, market expectations for two Fed rate cuts this year are strengthening.

Convergence of Policy Expectations

The divergence in monetary policy expectations between the US and Europe that we saw earlier is gradually narrowing. This convergence is providing some support for the euro’s exchange rate.

Short-Term Outlook

Despite recent gains, the fundamental economic landscape of a strong US and weak Europe remains unchanged. This situation is likely to continue putting pressure on the euro in the short term.

Prediction

Given these factors, the euro is expected to maintain a fluctuating trend within the range of 1.07-1.09 against the dollar in the near future.

In conclusion, while the euro has shown some strength recently, underlying economic factors suggest that significant gains may be limited in the short term. Investors and traders should keep a close eye on upcoming economic data and policy decisions from both the ECB and the Fed for further guidance on currency movements.