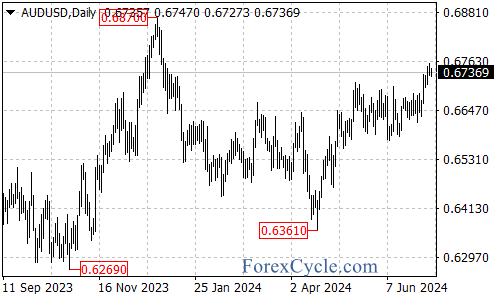

On Monday, July 8th, the Australian dollar (AUD) closed at $0.6737 against the US dollar (USD), down 0.18% for the day. This slight adjustment comes after the AUD/USD pair reached a six-month high of 0.6761 in Asian trading on Friday.

Key Factors Affecting the AUD/USD Pair

- Profit-Taking: The minor pullback on Monday can be attributed to profit-taking following Friday’s high.

- Commodity Pressure: A dip in commodity prices on Monday weighed on the Australian dollar.

- Diverging Central Bank Expectations: Despite the slight decline, the AUD’s downside appears limited due to differing rate expectations between the Reserve Bank of Australia (RBA) and the Federal Reserve.

- Market expectations for an RBA rate hike in August: 27% probability

- Probability of a Fed rate cut in September: 80%

Upcoming Events to Watch

- Fed Chair Powell’s Congressional Testimony: Tuesday/Wednesday

- US CPI Data: Thursday

These events could potentially stimulate further AUD gains if they indicate a likely Fed rate cut in September.

Technical Analysis

From a daily chart perspective:

- Bullish outlook if AUD/USD closes above 0.6750 (76.4% Fibonacci retracement of the April-December downtrend from 0.6870 to 0.6361)

- Next target: 0.6870

Key levels to watch:

- Resistance: 0.6770, 0.6800, 0.6840

- Support: 0.6700-10, 0.6675-80

In conclusion, while the AUD/USD pair experienced a slight dip on Monday, the overall outlook remains bullish. Traders should keep a close eye on upcoming US economic data and Fed commentary for potential catalysts that could drive the pair higher.