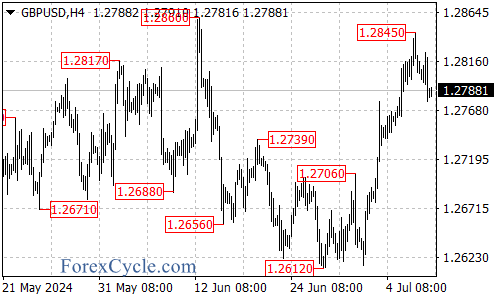

The British Pound (GBP) has shown impressive strength against the US Dollar (USD) recently, extending its upward move from 1.2612 to reach a high of 1.2845. However, the pair is now facing resistance at the 1.2860 level, which could lead to a period of consolidation.

Short-Term Outlook

After reaching 1.2845, we’ve seen a pullback, suggesting that a consolidation phase for the recent uptrend is underway. In the coming days, we can expect range-bound trading between two key levels:

- Support: 1.2740

- Resistance: 1.2845

Bullish Scenario

As long as the 1.2740 support holds, the overall uptrend remains intact. After this consolidation period, we could see another push higher to test the 1.2860 resistance level.

Key Levels to Watch

Resistance levels:

- Initial resistance: 1.2825

- If broken, watch for: 1.2845

- Above that: 1.2860

- Next target: 1.2900

Support levels:

- Initial support: 1.2760

- If broken, watch for: 1.2740

- Below that: 1.2710

Trading Strategy

Traders might consider:

- Looking for buying opportunities near the 1.2740-1.2760 support zone

- Taking profits or tightening stops as the pair approaches the 1.2845-1.2860 resistance area

- Being cautious of a potential breakout above 1.2860, which could signal a continuation of the broader uptrend

Remember to always use proper risk management techniques and consider multiple timeframes when making trading decisions based on this analysis.