The British Pound (GBP) has been showing strength against the US Dollar (USD) recently, driven by several key factors. Let’s break down the main drivers and potential future scenarios for the GBP/USD pair.

1. Interest Rate Differentials

Interest rate differences are a crucial fundamental driver for currency pairs, currently favoring the pound:

- UK real interest rate: 3.25%

- US real interest rate: 2.5%

This higher real interest rate in the UK is pushing GBP/USD higher and may continue to do so.Market expectations:

- 90% probability of a Fed rate cut in September

- Over two rate cuts expected from the Fed this year

- 57% probability of a Bank of England (BoE) rate cut in August

- Less than two rate cuts expected from the BoE this year

2. Economic Growth and Inflation Forecasts

The UK’s growth outlook has improved in recent weeks:

- May GDP growth: 0.4% (beating expectations of 0.2%)

- Driven by construction output growth and a slight improvement in the services index

This positive data may lead the BoE to revise economic growth expectations upward at its August meeting, potentially reducing the likelihood of a rate cut.Inflation forecasts for the UK may also be revised upward:

- Current CPI forecast: 2% this year, 2.6% next year

- The April living wage increase could impact core inflation later this year

- A new Labour government might extend the living wage further

3. Political Considerations

The BoE has good reasons to wait for the new government’s first budget before cutting rates, which could be positive for the pound. This is especially true considering that high interest rates don’t seem to be hindering the UK’s ongoing recovery from last year’s recession.

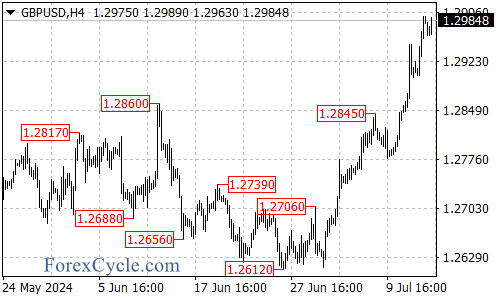

Potential GBP/USD Outlook

If GBP/USD manages to break above 1.30 in the coming days, it could potentially rise to 1.40, a level not seen since 2021.

In conclusion, the combination of favorable interest rate differentials, improving economic growth, and potential upward revisions to inflation forecasts are creating a supportive environment for the British Pound against the US Dollar. Traders should keep a close eye on upcoming economic data and central bank decisions for further direction.