On Friday, July 19th, the USD/JPY pair saw a slight increase of 0.07%, closing at 157.48. This movement came after mixed trading sessions following the release of Japan’s inflation data, which showed a second consecutive month of increases. For the week, the pair declined by 0.24%.

Key Factors Influencing USD/JPY

- Japanese Inflation Data: The recent data indicated a rise in Japan’s inflation rate, providing some support for the yen.

- BOJ Meeting Minutes: The Bank of Japan (BOJ) released minutes from a bond market group meeting, suggesting a reduction in Japanese government bond purchases to 3-4 trillion yen per month. This news also supported the yen.

BOJ Rate Decision Speculation

Despite these supportive factors, the yen could face pressure if the BOJ does not announce a rate hike at its upcoming policy meeting at the end of July.

Technical Analysis

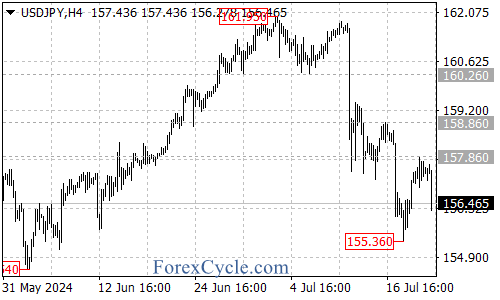

From a technical perspective, the USD/JPY pair remains in a downtrend with no clear signs of reversal. Key levels to watch include:

- Resistance Levels:

- Initial resistance: 157.86

- Next resistance: 158.86

- Support Levels:

- Initial support: 155.00-155.20

- Recent low: 155.36

Conclusion

The USD/JPY pair continues to navigate a complex environment influenced by economic data and central bank policies. Traders should monitor upcoming BOJ announcements and broader market trends to gauge the pair’s next moves. The current technical setup suggests that while there is some support for the yen, significant resistance levels could limit any substantial gains.