On Friday, July 19th, the Australian dollar (AUD) faced downward pressure against the US dollar (USD) due to several factors. Let’s break down the key influences and technical outlook for the AUD/USD pair.

Key Factors Affecting AUD/USD

- Risk-Off Sentiment: Global stock market declines have weighed on risk-sensitive currencies like the AUD.

- US Bond Yields: A rebound in US Treasury yields after a period of weakness has strengthened the USD.

- Commodity Prices: Iron ore, a major Australian export, has seen price declines, further pressuring the AUD.

Current Market Position

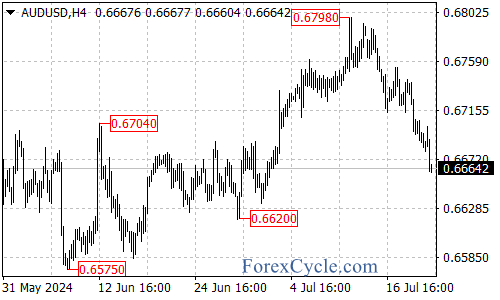

- AUD/USD dropped to 0.6660, its lowest level since July 3rd.

Positive Signals

Despite the recent pressure, there are some supportive factors for the AUD:

- CFTC Data: For the week ending July 16th, net AUD positions turned positive for the first time since May 2021.

- Monetary Policy Divergence: The expected policy differences between the Reserve Bank of Australia and the Federal Reserve could help limit the AUD’s downside.

Technical Analysis

The daily chart shows a slight bearish trend for the AUD. However, the outlook isn’t entirely negative:

- Key Support: 0.6660

- Bullish Signal: A move back above 0.6720 could prevent a deeper decline

Conclusion

While the AUD is facing short-term pressure from risk-off sentiment and commodity price declines, there are factors that could limit its downside. Traders should watch the key levels of 0.6660 for support and 0.6720 for potential bullish momentum. Keep an eye on global risk sentiment, commodity prices, and central bank communications for further direction.