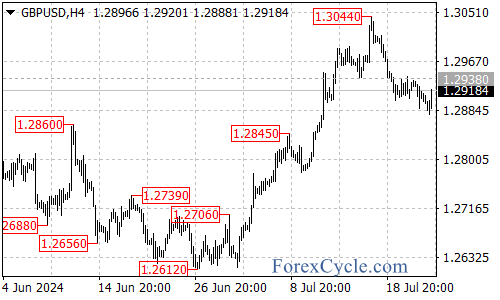

The GBP/USD pair has experienced a significant rally over the past two weeks, reaching a high of 1.3044 last Wednesday, the highest level since late July last year. However, the pair has since pulled back, currently trading around the 1.29 mark, as the US dollar index rebounded.

Factors Influencing GBP/USD

- Economic Data:

- Recent UK inflation and employment data met market expectations.

- However, retail sales data disappointed, with June’s seasonally adjusted retail sales dropping by 1.2%, significantly below the previous 2.9% and the expected 0.4%. This weaker-than-expected retail data has weighed on the pound.

- Monetary Policy:

- Despite the UK’s Consumer Price Index (CPI) remaining at 2% year-over-year, indicating persistent inflation, and strong wage growth, market expectations for a Bank of England (BoE) rate cut have been pushed from August to September. This delay in expected rate cuts has been supportive for the pound.

- USD Dynamics:

- This week, the US is set to release key economic data, including Q2 GDP growth estimates, June’s Personal Consumption Expenditures (PCE), and July’s Purchasing Managers’ Index (PMI). If these reports increase expectations for Federal Reserve rate cuts, the GBP/USD pair could see further gains.

Technical Analysis

From a technical perspective, the GBP/USD pair has faced resistance after failing to maintain levels above 1.30. Here’s a look at the key levels:

- Resistance: The pair faces resistance at 1.3020.

- Support: Initial support is seen at 1.2850.

Future Outlook

Given the interplay of various bullish and bearish factors, the GBP/USD pair is likely to enter a period of high volatility and range-bound trading. Traders should keep an eye on the key support and resistance levels for potential trading opportunities.

In conclusion, while the GBP/USD pair has shown significant strength recently, it remains influenced by a mix of economic data, central bank policies, and broader market dynamics. Monitoring these factors will be crucial for anticipating the pair’s next moves.