Recent developments in the USD/JPY pair have caught market participants off guard, with the Japanese yen making significant progress against the US dollar. This shift can be attributed to two main factors: a weakening dollar and suspected intervention by Japanese forex officials.

Unexpected Market Moves

In a surprising turn of events, Japan appears to have initiated large-scale yen purchases following positive news, such as lower-than-expected US inflation data. This strategy contrasts sharply with previous interventions, which typically occurred in response to negative news like higher-than-anticipated US inflation or economic growth.

Technical Analysis

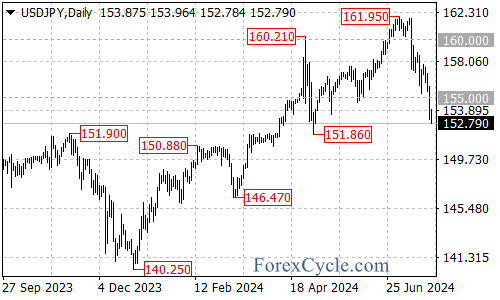

The daily chart for USD/JPY reveals that the short-term bearish reversal has finally materialized. Since this shift, the currency pair has been on a downward trajectory, breaking through crucial support levels at 160.00 and 155.00.

Looking Ahead

This week’s US Personal Consumption Expenditure (PCE) data could potentially extend this trend, especially if inflation shows an unexpected decline. However, if the data meets expectations, the downward trend may continue at a slower pace.

Key Support Levels to Watch

Traders should keep an eye on the following support levels:

- 151.90

- 150.00

These levels could provide significant support for the USD/JPY pair in the near term.

In conclusion, the recent movements in the USD/JPY pair highlight the importance of staying alert to both economic data and potential central bank interventions. As always, traders should approach the market with caution and employ proper risk management strategies.