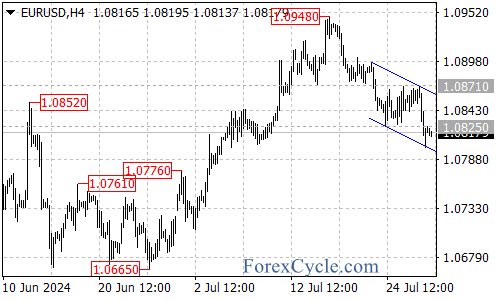

The EUR/USD pair has recently shown some price action, suggesting a continuation of its downward trend but with potential for a short-term rebound. Let’s break down the key levels and scenarios traders should watch.

Recent Developments

- EUR/USD failed to break above the 1.0870 resistance

- The pair broke below 1.0825, extending its downside move from 1.0948

- A new low of 1.0802 was reached, touching the bottom of the falling price channel on the 4-hour chart

Short-Term Outlook: Potential Rebound

Given that the pair has reached the bottom of the channel, we might see a rebound in the coming days. The initial target for this bounce would be the top of the channel.

Longer-Term Outlook: Downtrend Still in Play

Despite the potential for a short-term rebound, the overall downtrend remains intact as long as the price stays within the falling channel. Key levels to watch:

- Next downside target: 1.0770

- Further support: 1.0725 area

Potential Bullish Scenario

While the current trend is bearish, traders should be prepared for a possible trend reversal:

- Key level to watch: Channel resistance

- If price breaks above the channel: Look for a move towards 1.0870

- A break above 1.0870 could signal the completion of the downward move

- Next bullish target: Previous high at 1.0948

Conclusion

The EUR/USD pair is currently showing bearish momentum within a falling price channel. While a short-term rebound is possible, the overall trend remains downward as long as the pair stays within the channel. Traders should closely monitor the channel resistance for potential trend reversal signals.

Remember to always use proper risk management techniques and consider multiple timeframes when making trading decisions based on this analysis.