On Monday, July 29th, the Australian dollar (AUD) edged up by 0.02% against the US dollar (USD), closing at 0.6548. This slight rise comes as the AUD attempts to recover from last Friday’s low of 0.6510. The market’s focus is now on the upcoming Australian Q2 inflation report, set to be released on Wednesday, which will be crucial in determining the likelihood of an interest rate hike by the Reserve Bank of Australia (RBA) in August.

Key Factors to Watch

- Inflation Report:

- The market currently places a 20% chance on an August rate hike by the RBA.

- Economists expect a slight increase in overall inflation, with core inflation (trimmed mean) likely to remain steady at 4.0% year-over-year. This could increase pressure for tighter monetary policy.

- Expert Opinion:

- Blair Chapman, Senior Economist at ANZ, stated, “Even if Q2 CPI exceeds the RBA’s forecast slightly, the central bank may overlook some inflation components it can’t control and keep the overnight cash rate at 4.35% in August.”

Market Implications

- RBA Rate Decision: The probability of the RBA maintaining rates in August is high, with a lower likelihood of a rate hike.

- Short-Term Impact on AUD: Even if inflation rises, any boost to the AUD is expected to be short-lived and limited. The AUD’s ability to sustain gains will largely depend on the Federal Reserve’s stance on potential rate cuts in September.

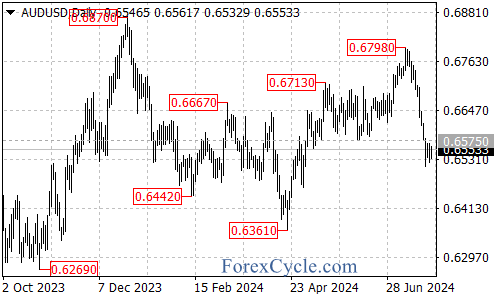

Technical Analysis

- Current Trend: The AUD/USD pair is consolidating in a low range, with significant events from major economies expected to keep it in a narrow trading band between 0.65 and 0.66.

- Resistance Levels: Short-term resistance is at 0.6548, with more significant resistance at 0.6600.

- Support Levels: Initial support is at 0.6510, with critical support at 0.6500.

Conclusion

The AUD/USD pair is currently in a consolidation phase, with the upcoming Australian inflation report playing a crucial role in determining its next move. While the RBA is likely to keep rates unchanged in August, any surprises in the inflation data could lead to short-term volatility. Traders should keep an eye on the key support and resistance levels and monitor the broader economic indicators for further direction.