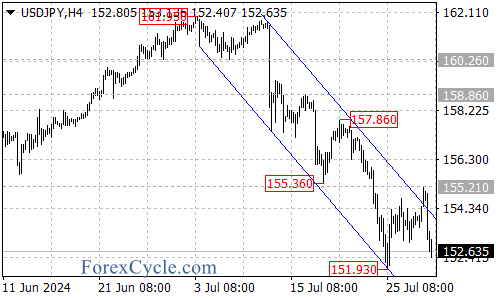

The USD/JPY pair has recently shown significant price action, indicating that the downtrend remains intact. After breaking above the top of the falling price channel on the 4-hour chart, the pair found resistance at 155.21 and subsequently dropped to 152.41. This movement suggests that the pair is still in a downtrend from 161.95.

Key Levels to Watch

- Support Levels:

- Immediate support: 151.93

- Next target: 150.90

- Further support: 150.00 area

- Resistance Levels:

- Initial resistance: 155.21

- Higher resistance: 155.80

- Major resistance: 158.00

Potential Scenarios

- Bearish Scenario:

- If USD/JPY breaks below the 151.93 support level, it could trigger further downside movement towards 150.90 and then 150.00.

- Bullish Scenario:

- On the upside, if the pair breaks above the channel resistance at 155.21, it could indicate that the downside move from 161.95 has completed. The next targets would be 155.80, followed by the 158.00 area.

Conclusion

The USD/JPY pair remains in a downtrend, but traders should keep an eye on the key support and resistance levels for potential trading opportunities. A break below 151.93 could lead to further declines, while a break above 155.21 could signal a trend reversal.

Remember to always use proper risk management techniques and consider multiple timeframes when making trading decisions based on this analysis.