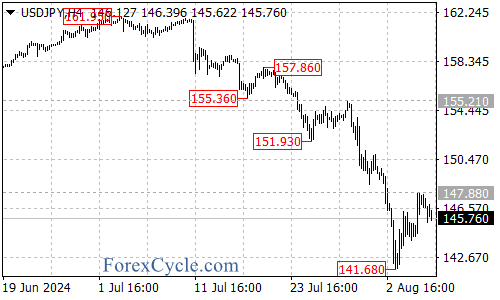

On Wednesday, August 7th, the Japanese yen experienced a decline, reaching a daily low of 147.88 against the US dollar. This movement followed comments from Shinichi Uchida, Deputy Governor of the Bank of Japan (BOJ), who emphasized the need to maintain the current level of accommodative monetary policy due to significant volatility in domestic and international financial markets. His remarks downplayed the likelihood of a near-term interest rate hike, easing investor concerns about further yen appreciation that could disrupt global markets.

Market Implications

Uchida’s comments helped temper the yen’s recent strong rally. The currency’s future movements will be influenced by two major factors:

- Federal Reserve’s Rate Decisions: Investors are closely watching whether the Federal Reserve will begin cutting rates soon.

- BOJ’s Monetary Policy: The potential for further rate hikes or bond tapering by the BOJ remains a critical factor.

Technical Analysis

From a technical standpoint, the yen’s depreciation from the beginning of the year until July (140.25 to 161.95) has almost fully retraced. The current oversold condition suggests the possibility of a short-term correction as traders cover short positions. However, given the broader market reversal, a return to the yen’s previous significant depreciation trend seems unlikely. After adjustments, the yen may continue to gravitate towards its value center.

In conclusion, while the yen’s recent volatility has been notable, the overall outlook suggests a stabilization phase. Traders should keep an eye on central bank policies and global economic indicators to gauge future movements.