On Wednesday, August 7th, the Australian dollar (AUD) slipped by 0.01% against the US dollar (USD), closing at 0.6517. This drop erased an earlier 0.85% gain, leaving the AUD nearly unchanged from the previous day’s close.

Recent Developments

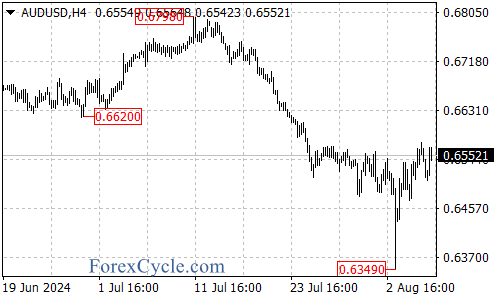

The Reserve Bank of Australia recently ruled out the possibility of a rate cut this year, citing expectations that core inflation will only decline slowly. This decision has kept the AUD under pressure over the past few days. Despite showing signs of stabilization and a potential slow recovery, the AUD fell to an eight-month low earlier this week following a global market downturn.

However, the currency saw some recovery on Wednesday after comments from the Deputy Governor of the Bank of Japan. The AUD briefly reached a high of 0.6574 during the session. Despite this, the upward momentum was weak, and the currency faced significant selling pressure towards the end of the trading day.

Technical Outlook

From a technical perspective, the AUD/USD remains in a consolidation pattern near recent lows. Without any major news to drive the market, the pair is expected to continue trading within a narrow range, primarily between 0.6440 and 0.6580.

Conclusion

The Australian dollar is currently navigating a challenging environment, with limited upward momentum and ongoing market volatility. Traders should keep an eye on central bank announcements and global economic indicators for potential impacts on the AUD/USD pair. As always, proper risk management is essential when trading in such uncertain conditions.