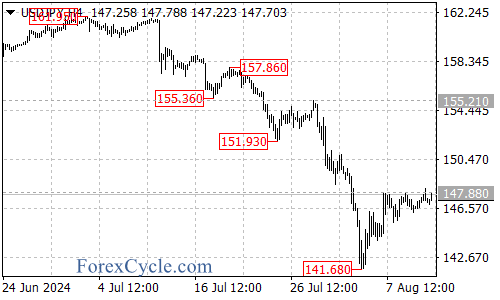

On Monday, August 12th, the USD/JPY pair briefly surged above the 148 level before experiencing a pullback. Recent data from the Commodity Futures Trading Commission and the London Stock Exchange Group revealed that leveraged funds have reduced their short positions on the yen to the lowest net short level since February 2023.

Market Reactions

Following the release of U.S. unemployment claims data, which came in below expectations, concerns about a recession in the U.S. eased. This led to a slight stabilization of the dollar after a significant decline. Additionally, comments from Japanese central bank officials indicated that the Bank of Japan is unlikely to rush into further interest rate hikes, which has contributed to the yen’s weakness. As a result, the USD/JPY pair has entered a period of adjustment in recent days.Jane Foley, head of foreign exchange strategy at Rabobank in London, noted that volatility may increase towards the end of the year due to the upcoming U.S. elections and the possibility of Federal Reserve rate cuts. This suggests that the yen’s depreciation, driven by carry trades, may gradually diminish.

Key Levels to Watch

As we approach Wednesday’s U.S. Consumer Price Index (CPI) data release, traders should monitor the resistance level at 148. If the price breaks above this level, the USD/JPY could challenge the 150 mark. Conversely, if the pair remains below 148, it may continue its downward trajectory.

Conclusion

The USD/JPY pair is currently navigating a complex market environment, influenced by economic data and central bank policies. Traders should keep a close eye on the 148 resistance level and the implications of upcoming economic reports. As always, proper risk management is essential when trading in such volatile conditions.