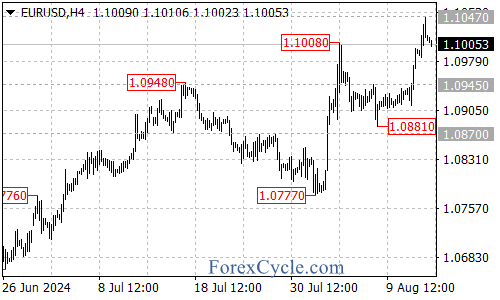

The EUR/USD pair has recently broken above the resistance level of 1.1008, extending its upward movement from 1.0777 to a high of 1.1047. Following this rise, a pullback from 1.1047 suggests that the market is now consolidating, setting the stage for potential future movements.

Current Market Outlook

In the coming days, we can expect range trading between 1.0945 and 1.1047. As long as the support at 1.0945 holds, the bullish trend may resume. A breakout above 1.1047 could lead to further gains, with the next target at around 1.1100.

Key Levels to Watch

- Resistance Levels:

- 1.1008: The recent breakout level.

- 1.1047: The current high, which needs to be surpassed for further upside.

- Next Target: If the price breaks above 1.1047, the next resistance level is 1.1100.

- Support Levels:

- Initial Support: 1.0985.

- A breakdown below this level could lead to a decline back to 1.0945.

- If the price falls below 1.0945, it may aim for the 1.0900 area.

Market Outlook

The recent pullback indicates a consolidation phase after the bullish move. If the EUR/USD can maintain support above 1.0945, we may see a continuation of the upward trend. However, if the price fails to hold this support, it could lead to further declines towards the lower support levels.

Conclusion

The EUR/USD pair is currently at a critical juncture, with key resistance and support levels in play. Traders should closely monitor the 1.0945 support and the 1.1047 resistance for potential trading opportunities. A breakout above 1.1047 could signal a strong bullish trend, while a drop below 1.0945 may indicate a bearish shift.

As always, it’s essential to practice proper risk management and stay informed about economic developments that could impact the EUR/USD pair in the coming days.