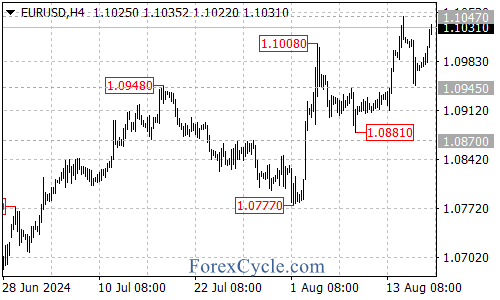

The EUR/USD pair has failed to break below the crucial support level at 1.0945 and is now facing resistance at 1.1047. This price action suggests a potential consolidation phase before the next move.

Key Levels to Watch

- Resistance Levels:

- 1.1047: A breakout above this level would indicate that the upside move from 1.0777 has resumed.

- Next Targets: If the price breaks above 1.1047, the next targets would be the 1.1100 area, followed by 1.1200.

- Support Levels:

- 1.0980: This is now the initial support level to watch.

- 1.0945: A breakdown below 1.0980 could trigger a decline towards testing this key support.

- 1.0900: If 1.0945 is breached, the price may aim for the 1.0900 area.

Market Outlook

The failure to break below 1.0945 suggests that the bulls are defending this level. However, the pair is now facing resistance at 1.1047. A breakout above this level would be a bullish signal, potentially leading to further gains towards 1.1100 and 1.1200. On the other hand, if the price falls below 1.0980, it could trigger a decline towards testing the 1.0945 support. A breakdown below 1.0945 may extend losses towards 1.0900.

Conclusion

The EUR/USD pair is at a critical juncture, with 1.1047 resistance and 1.0945 support acting as key levels. Traders should closely monitor the price action around these levels to identify potential trading opportunities. A breakout above 1.1047 could signal a resumption of the uptrend, while a breakdown below 1.0945 may indicate a bearish shift in momentum.

As always, ensure proper risk management and stay informed about economic indicators that could impact the EUR/USD pair in the coming days.