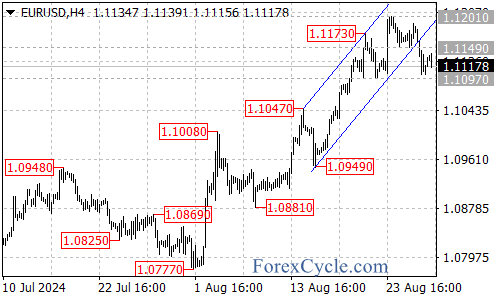

EUR/USD has broken below the rising price channel on the 4-hour chart and is now approaching the key support level at 1.1097.

What’s Next?

- Consolidation Phase:

- As long as the price remains above the 1.1097 support level, the recent decline from 1.1201 can be viewed as a consolidation within the broader uptrend that began at 1.0777.

- After this consolidation, another rise toward the 1.1300 area is still possible.

- Key Resistance Levels:

- Initial resistance is at 1.1100.

- A break above this level could spark another push higher, retesting the 1.1201 resistance.

- If the price breaks above 1.1201, the next targets would be around the 1.1300 and 1.1450 areas.

- Downside Risk:

- If the price breaks below the 1.1097 support, it would suggest that the uptrend from 1.0777 has likely ended at 1.1201.

- In this case, the next support level to watch would be around 1.1070.

Conclusion

EUR/USD has dipped below its rising price channel, but the uptrend may still resume if key support at 1.1097 holds. Traders should watch for a potential breakout above 1.1100, which could lead to further gains toward 1.1300 and beyond. However, a break below 1.1097 could signal a shift in momentum, with support around 1.1070 likely to be tested next.