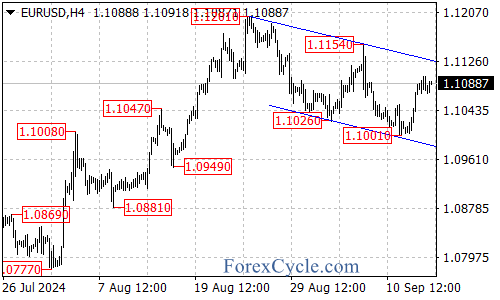

The EUR/USD pair has successfully broken above the 1.1050 resistance, indicating that the downside move from 1.1154 may have completed at 1.1001. Despite this positive movement, the pair remains within a falling price channel on the 4-hour chart, suggesting a longer-term downtrend from the high of 1.1201.

As long as the channel resistance holds, the bounce from 1.1001 is likely a consolidation within the broader downtrend, and another decline toward the 1.1000 support remains possible after this consolidation phase.

Initial support is located at 1.1065. A breakdown below this level could lead the price back toward the 1.1000 support, and if that level fails, the focus would shift to the next support level at 1.0960, followed by the 1.0900 area.

On the upside, a breakout above the channel resistance would suggest that the downside movement from 1.1201 has indeed completed at 1.1001, with the next target around the 1.1150 area, followed by the previous high resistance at 1.1201.