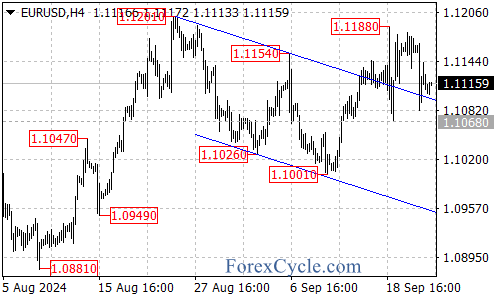

The EURUSD pair has hit a roadblock, failing to break above the 1.1188 resistance level. As a result, it’s now confined to a trading range between 1.1068 and 1.1188, leaving traders wondering about its next move.

Despite this consolidation, the broader uptrend from 1.1001 remains intact as long as the 1.1068 support holds. This sideways movement could be seen as a pause in the larger bullish trend, potentially setting the stage for another attempt at the 1.1188 resistance.

If the pair manages to break above 1.1188, it could signal a resumption of the uptrend. In this scenario, traders might set their sights on the 1.1250 area, with a possible extension towards 1.1300. However, before reaching these levels, the pair needs to overcome the initial resistance at 1.1145.

On the flip side, a breakdown below the crucial 1.1068 support could change the short-term outlook. Such a move might push the pair towards the next support level around 1.1040, with the previous low of 1.1001 serving as a key area to watch.

As the EURUSD continues to navigate this range, traders should stay alert for any signs of a breakout or breakdown that could dictate the pair’s next significant move. The coming sessions may provide valuable insights into whether the euro can regain its upward momentum against the dollar.