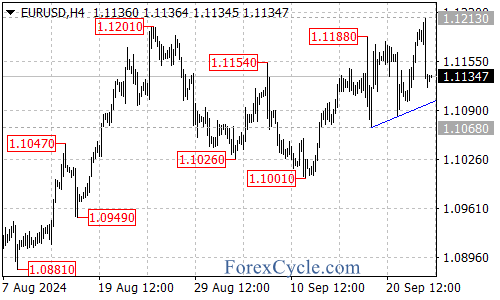

The EURUSD pair has experienced a pullback after breaking above the significant 1.1200 resistance level. After reaching a high of 1.1213, the pair retreated to 1.1121, leaving traders wondering about its next move.

Despite this setback, the overall uptrend from 1.1001 remains intact. The key to watch is the rising trend line visible on the 4-hour chart. As long as the price stays above this line, the current pullback can be viewed as a consolidation phase within the broader uptrend.

If this interpretation holds true, we could see another attempt to breach the 1.1200 resistance after the consolidation ends. A successful breakout above this level could pave the way for further gains, with potential targets at 1.1250 and possibly extending to the 1.1300 area.

However, caution is warranted. If the price breaks below the rising trend line, it could signal a deeper correction. In this scenario, the next level to watch would be the key support at 1.1068. A breach below this support could indicate that the uptrend has run its course.

As the EURUSD navigates this crucial juncture, traders should keep a close eye on the rising trend line and the 1.1200 resistance. These levels could provide valuable clues about whether the pair will resume its upward trajectory or if a more significant correction is in store.