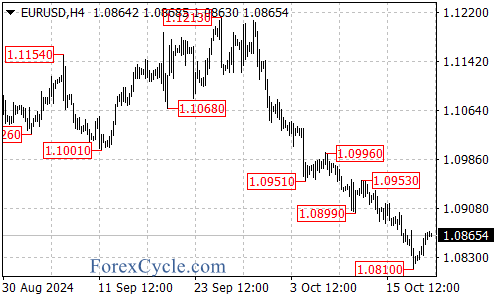

The EURUSD pair has continued its downward trajectory, extending its decline from 1.1213 to reach a new low of 1.0810. However, the recent bounce from this level has sparked interest among traders, raising questions about whether this is a temporary pause or the beginning of a reversal.

Currently, the market appears to be in a consolidation phase, with the recent bounce potentially serving as a brief respite in the ongoing downtrend. Traders are now closely watching the key resistance level at 1.0880, which could prove crucial in determining the pair’s next significant move.

If the 1.0880 resistance holds firm, we might see a continuation of the downward trend. In this scenario, a breakdown below 1.0845 could trigger another leg down, potentially retesting the recent low at 1.0810. Should this support fail to hold, the bears might push towards the 1.0780 area, with 1.0730 serving as the next significant target.

However, the bulls aren’t out of the game yet. A breakout above the 1.0880 resistance would be a significant development, possibly indicating that the downside move from 1.1213 has found its bottom at 1.0810. If this occurs, traders should be prepared for a potential upside move, with 1.0920 serving as the initial target, followed by the psychologically important 1.1000 level.

As the EURUSD navigates this critical juncture, market participants will be closely monitoring price action around these key levels. The pair’s behavior in the coming days will provide valuable insights into whether the downtrend is merely pausing or if a more significant reversal is in the cards.