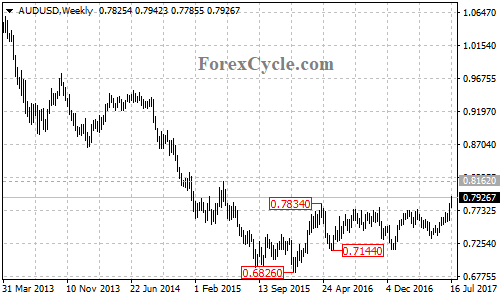

AUDUSD recently broke above a major resistance at the April 2016 high of 0.7834, indicating that the sideways movement in the range between 0.7144 and 0.7834 is complete.

The AUDUSD pair stays above a bullish trend line with support at 0.7635 on its daily chart and remains in the uptrend from 0.7328. As long as the price is above the trend line, the uptrend could be expected to continue and next target would be at the May 2015 high of 0.8162. There is another important resistance located at the 38.2% Fibonacci retracement taken from the July 2011 high of 1.1080 to the January 2016 low of 0.6826 at around 0.8450. This would be the final target of the upside movement.

On the downside, the whole upside movement started from 0.6826 is likely consolidation of the long term downtrend from 1.1080, and we notice there is a bearish price channel with resistance at 0.7900 on its monthly chart. If the pair fails to break and settle above the channel resistance, the long term downtrend will resume. Near term support is at 0.7780, a breakdown below this level could take price back to test the support of the bullish trend line on the daily chart, a clear break below the trend line support will signal completion of the uptrend from 0.7328, then the following downside movement could bring price to retest 0.6826 previous low support.

Technical levels

Support levels: 0.7780 (near term support), 0.7635 (the bullish trend line on the daily chart), 0.7328 (the May 9 low), 0.7144 (the May 2016 low), 0.6826 (the January 2016 low).

Resistance levels: 0.7900 (the top of the price channel on the monthly chart), 0.8162 (the May 2015 high), 0.8450 (the 38.2% Fibonacci retracement).