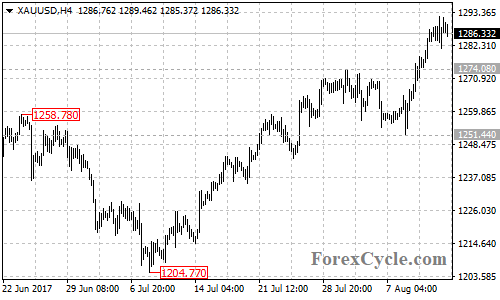

After a minor consolidation, XAUUSD moved above 1274.08 resistance and extended its upside movement from 1204.77 to as high as 1292.05, facing the important psychological level at 1300 once again.

On the upside

The gold price stays above the bullish trend line from 1204.77 to 1251.44, with support now at around 1260 on its daily chart. As long as the trend line support holds, the upside movement could be extended to continue and further rise to test 1300 resistance is possible in the coming days.

A break out of 1300 resistance will indicate that the bullish movement from the December 2016 low of 1122.56 has resumed, then next target would be at the November 2016 high of 1337.28, followed by the July 2016 high of 1375.11.

On the downside

A clear break below the bullish trend line on the daily chart could bring price back to test 1251.44 key support. Below this level will confirm that the upside movement from 1204.77 is complete, then deeper decline to test 1204.77 support could be seen. A breakdown below 1204.77 level could take price into 1170 zone.

There is a bullish trend line on the weekly chart, with support now at around 1170. This would be the final target of the downside movement.

Technical levels

Support levels: 1260 (the bullish trend line on the daily chart), 1251.44 (the August 8 low), 1204.77 (the July 10 low), 1170 (the support trend line on the weekly chart).

Resistance levels: 1295.94 (the June 6 high), 1300 (the important psychological level), 1337.28 (the November 2016 high), 1375.11 (the July 2016 high).