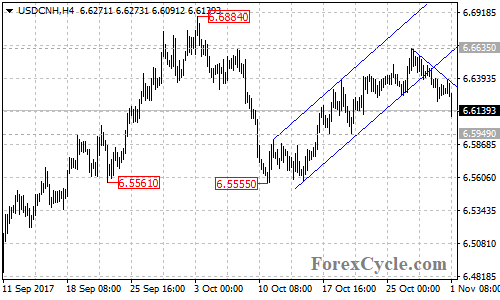

USDCNH recently broke below the bullish price channel on the 4-hour chart, suggesting that the short term uptrend from 6.5555 had completed at 6.6635 already. Further decline would likely be seen over the next several days.

The USDCNH pair is expected to test 6.5949 support, a breakdown below this level could take price to next support level at 6.5555. Below this level would aim 6.5350, which is the 61.8% Fibonacci retracement taken from 6.4412 to 6.6884, followed by the 76.4% retracement at 6.5000. If these levels give way, the pair would find support at 6.4412.

A breakdown below 6.4412 support will indicate that the long term downtrend from 6.9867 has resumed, then the following downside movement could take price to 6.3860, which is the 61.8% Fibonacci support taken from 6.0152 to 6.9867.

Near term resistance is at the falling trend line on the 4-hour chart, now at around 6.6360. Only a clear break above this trend line could indicate that the short term downtrend from 6.6635 is complete, then the following upside movement could bring price back to test 6.6635 resistance. A breakout of this level could trigger further upside movement towards 6.6884 key resistance.

For long term analysis, the USDCNH pair moved within a bearish price channel on its weekly chart, suggesting that the price remains in the long term downtrend from 6.9867. As long as the price is in the channel, the rise from 6.4412 could be treated as consolidation of the downtrend and further decline to 6.3860 area is still possible. However, a breakout of 6.6884 key resistance will signal completion of the downtrend, then the next target would be at 6.7210, followed by 6.8588.

Technical levels

Support levels: 6.5949 (the October 20 low), 6.5555 (the October 11 low), 6.5350 (the 61.8% Fibonacci retracement), 6.5000 (the 76.4% Fibonacci retracement), 6.4412 (the September 8 low), 6.3860 (the 61.8% Fibonacci support).

Resistance levels: 6.6360 (the falling trend line on the 4-hour chart), 6.6635 (the October 27 high), 6.6884 (the October 3 high), 6.7210 (the June 1 low), 6.8588 (the June 26 high), 6.9170 (the important resistance on the daily chart), 6.9867 (the January 3 high), 7.0000 (the important psychological level).