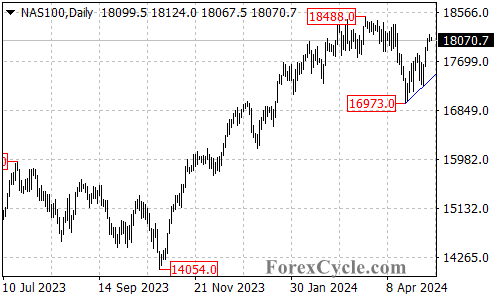

The Nasdaq 100 index (NAS100) has staged an impressive bounce from the 16,973 low, rallying as high as 18,170 in recent trading sessions. However, this upside move is likely a corrective bounce within the broader downtrend from the 18,488 high. Another leg lower could potentially unfold after the current correction runs its course.

Key Support at 17,870

In the near-term, the first level of support to watch on the downside is the 17,870 area. A breakdown below this level could see the NAS100 retrace back toward the rising trendline support visible on the daily chart.If sellers can push the index below the daily trendline support, it would likely trigger a more substantial downside move to retest the 16,973 low.

Potential for Deeper Losses Below 16,973

A break below the 16,973 support would be a significant technical event, likely opening the door for a continuation of the downtrend toward the 16,500 area.

Bullish Scenario on Break Above 18,488

On the flip side, if the NAS100 can clear the 18,488 previous high resistance, it would likely signal that the longer-term uptrend from the October 2022 low of 10,437 has resumed.In this scenario, the next key upside target for the index would be the 19,200 zone.

Key Levels to Watch

For now, the key levels to watch in the NAS100 are the 17,870 and 16,973 support areas, along with the rising daily trendline support and the 18,488 resistance barrier.

As long as the index remains below 18,488, the overall technical bias will remain bearish, with the potential for a retest of the 16,973 low and a possible continuation toward the 16,500 area.

However, a breakout above 18,488 would be a significant technical event, likely opening the door for a more substantial recovery toward the 19,200 target.

The NAS100 finds itself at an important technical crossroads after the recent bounce from 16,973. The direction of the next big move will likely be determined by the index’s ability, or inability, to clear the 18,488 resistance barrier in the sessions ahead.