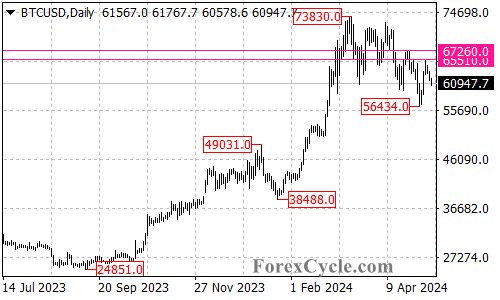

The BTCUSD cryptocurrency pair has extended its pullback from the 73,830 high, falling as low as 56,434 in recent trading sessions. Further near-term losses toward the 52,000 area appear possible as the correction unfolds.

Consolidation Within Uptrend

Despite the recent selling pressure, the decline from the 73,830 high is likely a consolidation phase within the longer-term uptrend that originated from the November 2022 low of 15,385.After this consolidation period, another rise in the BTCUSD could potentially unfold as the uptrend resumes.

Key Resistance Levels

In the near-term, the first key resistance level to watch is at 62,400. A breakout above this level could potentially trigger an upside move to test the 65,510 and 67,260 resistance zones.If the BTCUSD can clear the 67,260 barrier, it would likely signal that the longer-term uptrend from the 15,385 low has resumed, with the next key upside target being a retest of the 73,830 high.

Downside Risks Remain

While the longer-term technical outlook remains constructive, traders will want to keep a close eye on the 52,000 area as potential support on further weakness. A breakdown below this level could potentially open the door for a more significant correction within the broader uptrend.

Key Levels to Watch

For now, the key levels to watch in the BTCUSD are the 62,400, 65,510, and 67,260 resistance levels, along with the 52,000 support area.

As long as the 52,000 support holds, the overall technical bias will remain tilted to the upside, with the potential for a resumption of the longer-term uptrend if the 67,260 resistance is cleared.

However, a breakdown below 52,000 would be a significant technical event, likely opening the door for a deeper pullback within the uptrend from the 15,385 low.

The BTCUSD has pulled back from its highs, but the longer-term uptrend remains intact for now. Traders will want to closely monitor the key support and resistance levels to determine if the current consolidation is complete or if a more significant correction could unfold.